What You Need to Know Ahead of MarketAxess Holdings’ Earnings Release

/MarketAxess%20Holdings%20Inc_%20logo%20with%20data%20background%20by-Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at $8.4 billion by market cap, New York-based MarketAxess Holdings Inc. (MKTX) operates an electronic trading platform for institutional investors and broker-dealer companies worldwide. It focuses on expanding liquidity opportunities, improving execution quality and cost savings across global fixed-income markets.

MarketAxess is set to announce its Q1 results before the markets open on Wednesday, May 7. Ahead of the event, analysts expect MKTX to report a non-GAAP profit of $1.82 per share, down 5.2% from $1.92 per share reported in the year-ago quarter. On a positive note, the company has surpassed Wall Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, MKTX is expected to report an adjusted EPS of $7.62, up 4.7% from $7.28 in fiscal 2024. While in fiscal 2026, its earnings are expected to surge 12.5% year-over-year to $8.57 per share.

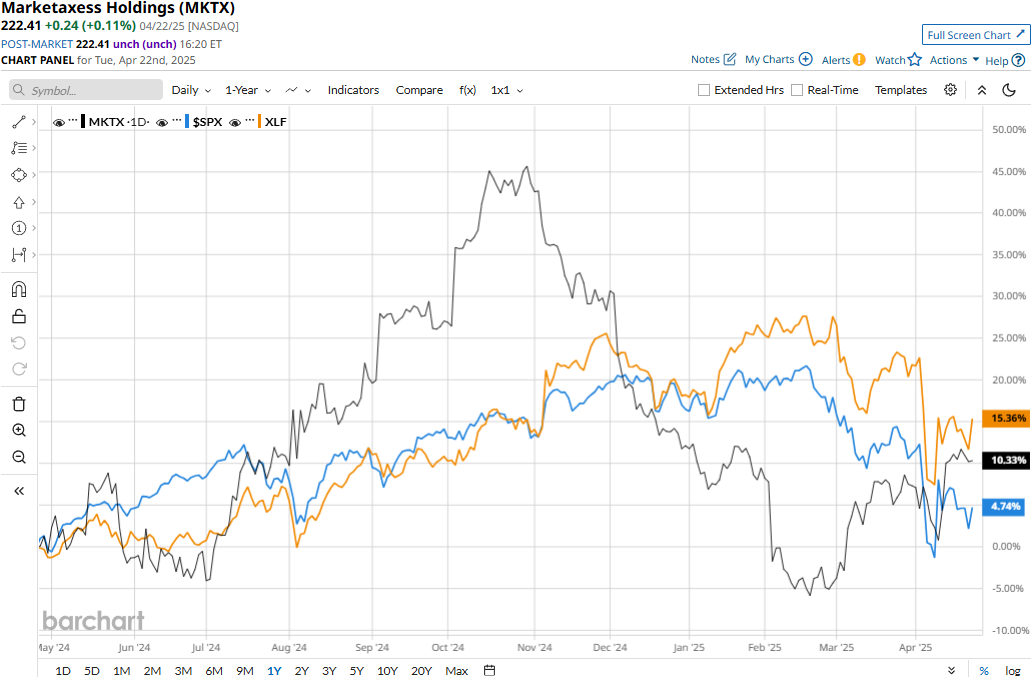

MKTX stock has gained 8.8% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 5.5% uptick while lagging behind the Financial Select Sector SPDR Fund’s (XLF) 15.4% surge over the same time frame.

MarketAxess’ stock prices rose 1.6% after the release of its Q4 results on Feb. 6. Driven by a notable growth in emerging markets and Eurobond commissions, the company’s topline increased nearly 3% year-over-year to $202.4 million. However, this figure fell short of Street expectations by a thin margin. Meanwhile, its net income for the quarter decreased almost 6% year-over-year to $65.1 million. Nonetheless, its earnings of $1.73 per share surpassed the consensus estimates by 1.8%, which boosted investor confidence.

The consensus view on MKTX stock is cautiously optimistic, with a “Moderate Buy” rating overall. Of the 14 analysts covering the stock, opinions include four “Strong Buys,” one “Moderate Buy,” eight “Holds,” and one “Moderate Sell.” Its mean price target of $234.83 suggests a modest 5.6% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.